Real estate disposal tax:

The most accurate details of the Real Estate Act 2021:

The law stipulates from the Real Estate Actions that a rate of 2.5% be paid without any reduction in the total exchange value of the built real estate or the lands for construction on which except for the villages. Whether the disposition is focused on it or after the establishment of facilities on it, whether this behavior includes all or part of the deal.

Is the inherited property excluded?

The abolition of the exemption specified for the disposition of the heir to the inheritance acquired to him in order to achieve tax justice, and this cancellation has nothing to do with the inheritance tax, the devolution and legally canceled and not returning it, as the real estate tax is due to be collected upon sale and not upon the inheritance.

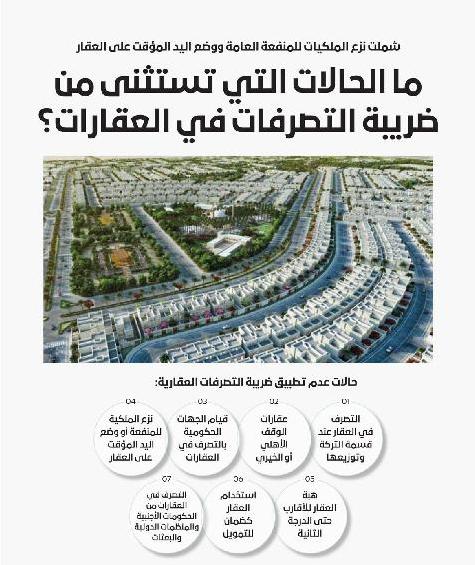

What are the cases exempt from the real estate disposal tax?

Neither the real estate investment companies nor the real estate investment companies are addressed with this tax when selling real estate units, as the profits of these companies are subject to tax on commercial profits, but the prohibition established by law applies to those units when the ownership of any unit is transferred from the first buyer to the assignor, except after verifying that he has paid the tax Due from real estate disposal on the residential unit, land or real estate subject of disposal

Excluded from being subject to this tax are cases of submitting the real estate with a sample share to a joint stock company, provided that the corresponding shares are not disposed of for a period of 5 years, and the property is donated to the government or local government units, or cases of expropriation or public benefit projects

Payment methods?

The disposer may pay the real estate disposal tax in the financed account disposed of in one payment or in three installments Equally, the first installment of which is to be paid, accompanied by the submission of the installment request and the second installment on the first day after the expiration of six months from the date of the first installment payment, and the last installment on the first day after the expiration of six months from the date of the payment of the second installment. This law shall start from the day following the expiry of the specified period, and the breaking of the month obliges the month in the calculation of the indicated periods.

* - Those who are subject to this tax must submit the necessary notification to the competent tax office to avoid delay penalties that are added from the expiration date of the period specified for the notification, which is 30 days from the event of the disposition.